PortfolioWise Blog

The Market May Or May Not Crash But Even If It Does, You Don’t Have To Follow It Down

I just searched “stock market bubble” and Google returned “About 127,000,000 results.” Changing “bubble” to “crash” boosted the total to 268,000,000. Steve Sjuggerud opened his March 15, 2021 Stansberry Daily Wealth commentary by announcing that “The Melt Up will end sometime this year”

Beware the Crowds

This is not a commentary about social distancing, or the need to stay away from large gatherings due to the risk associated with the spread of the coronavirus—although it could be, because we are all very well read on the supposed need to do so. It is about the risk to investors who follow the

This Leading Economic Indicator is first in the Supply Chain Line.

Chemicals are in everything and are a necessity in nearly every product we consume. Since chemicals are at the early position in the supply chain, an uptick in this area could prove to be an interesting indicator for future growth of our economy. From cell phones to soap, there is a chemical compound that is

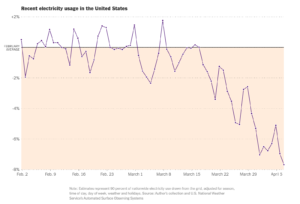

Maybe The Market is Not Wrong on the Economy

Last week the US economy lost 20.5 million jobs in the month of April. We all knew it was going to be a big number, we all knew that it was likely to be in the twenties. In fact estimates were in the range of 21 – 22 million. The report was released on Friday

Actively managing passive investments while acting in the Best Interest of your client

How do you know if you have the best ETF in your model? As a follow-up to my Monday blog post on Modern Portfolio Theory, I wanted to show some ways to use PortfolioWise to help you act in the best interest of your client while actively managing an ETF portfolio. As an advisor, I

My Maserati does 185

Recently I was contemplating how many investment platforms and tools I have used over the years managing money as a portfolio manager. Most professional money managers have a pretty hefty budget to allocate toward research, and in particular systems to help them do the research to determine what specific securities to invest in. One of

Revisiting Modern Portfolio Theory: Was it meant to guide investors to be invested through every type of market condition?

For many years, investors and advisors have struggled with the idea of buy and hold versus market timing. There have been many research pieces claiming Modern Portfolio Theory, MPT, to be dead. Alongside that research, there have been decades of marketing messages from several asset management firms referencing diversification strategies as being what works best*.

We Are Not Warren Buffett and That’s OK

Let’s start by saying that I am a fan. I have been following Warren Buffett since I was in college. On the morning of February 22, 2020, I woke up, made a pot of coffee and settled in to read the annual letter from Berkshire Hathaway, the same thing that I have done on the

Who the Biggest Players in the Covid Vaccine Race are, and Where you ACTUALLY should be looking for profits.

The most obvious way to make money out of this virus would be to accurately predict which company will create the first vaccine. However, trying to pick the company that is going to create the first Covid vaccine requires more of a “magic 8 ball” than I am comfortable with betting my money on. No

Differentiate Carefully Between Growth ETFs And Glamor

I started out looking for large-cap growth ETFs but hated the portfolios I was seeing. So I switched things up, ignoring size and searching in oddball ways. I avoided ETFs with extremely high concentrations in big-name FANG-type stocks. I want sincere-credible growth-finding methodologies, not passive cap-weighted big-name run-ups or active performance chasing Good news: I

“What about GOLD, Marty”?

In the late 1990’s, early in my career managing mutual funds with my mentor Dr. Martin Zweig, we would get on a weekly call with Advisors who had clients in our funds to answer questions about the markets and what Marty was thinking. Invariably someone would ask, “What about gold, Marty”? Gold peaked in September

5 Ways Coronavirus-Driven Social Distancing May Change Your Investing Strategy

There may be long-term changes to your investing strategy as social distancing measures take hold to stop the spread of coronavirus. Social distancing has affected our lives in somewhat strange ways. Handshakes have given way to nods and waves. Masks are now fashion accessories. Rush hour traffic is a term probably more applicable to the

It’s the Story That Sells the ETF

The creativity in the ETF universe never ceases to amaze. Pick a theme, any theme, and there is likely a way for you to invest in it or one is in the works. But how do you know which themes are enduring and which are hype? Can you look past the narrative? Let’s start by